Driving without insurance in Saudi Arabia is illegal. Every vehicle owner must have at least basic coverage before hitting the road. But here’s the good news – you don’t have to pay a fortune for protection.

Many residents overpay simply because they don’t know where to look. Whether you’re a Saudi citizen or expatriate, this guide will show you exactly how to get the lowest rates without sacrificing quality coverage.

Understanding Your Insurance Options

Before hunting for cheap rates, know what you’re buying. Saudi Arabia offers two main types of vehicle coverage:

Third Party Liability (TPL)

This is the minimum legal requirement. It covers:

- Damage you cause to other vehicles

- Injuries to other people

- Property damage to third parties

It does NOT cover your own car.

Average cost: SAR 700 – 1,500 per year

Comprehensive Coverage

This protects everything – including your own vehicle. It covers:

- All third party damages

- Your own car repairs

- Theft protection

- Natural disaster damage

- Fire damage

Average cost: SAR 2,000 – 8,000+ per year

Which Coverage Should You Choose?

| Your Situation | Recommended Coverage |

|---|---|

| Old car (5+ years) | Third Party |

| New or expensive car | Comprehensive |

| Financed vehicle | Comprehensive (usually required) |

| Tight budget | Third Party |

| Frequent highway driver | Comprehensive |

The Easiest Way to Compare Prices Online

Gone are the days of visiting multiple insurance offices. Now you can compare dozens of quotes from your phone in minutes.

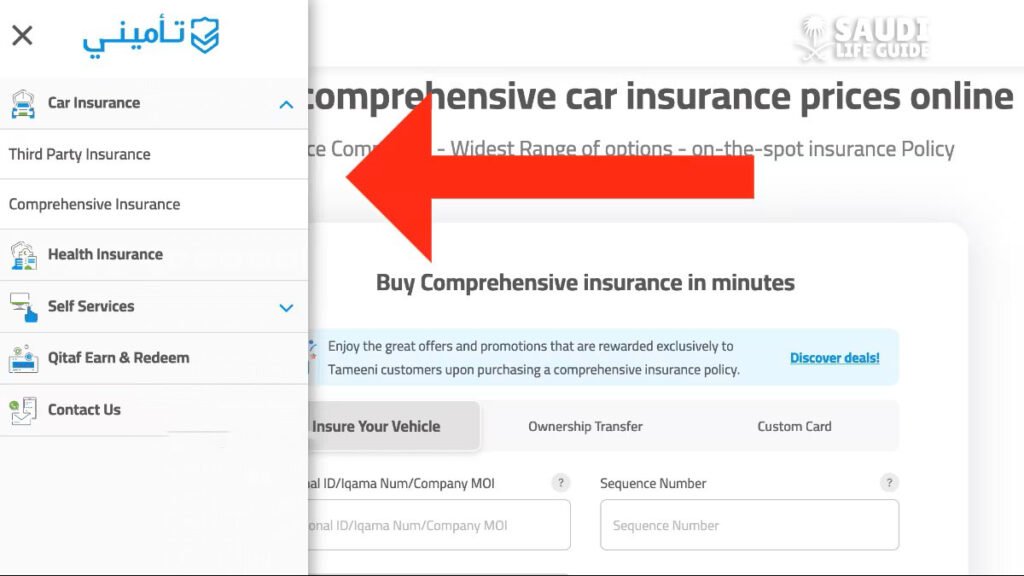

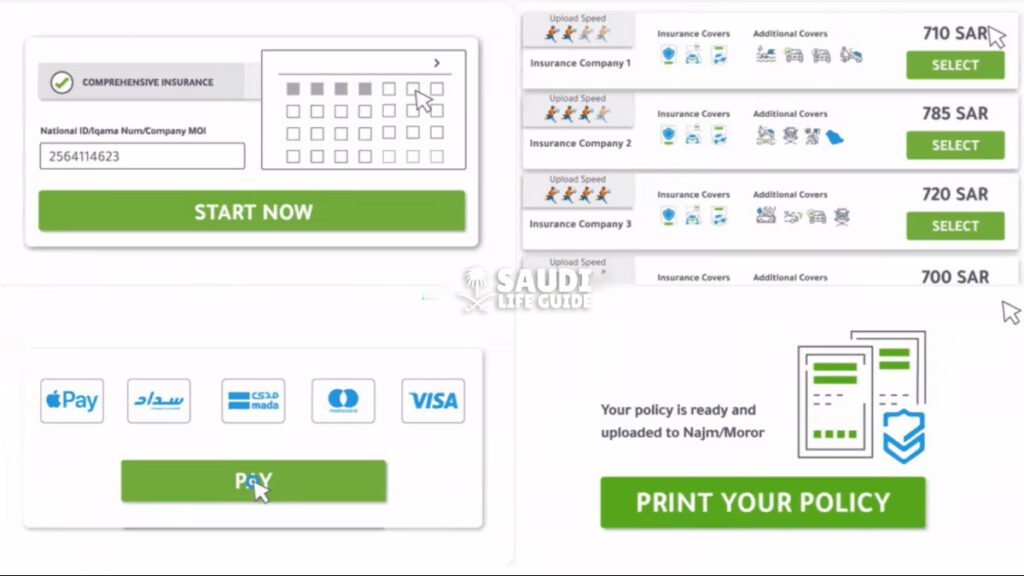

Using Tameeni – Step by Step

Tameeni is Saudi Arabia’s largest insurance comparison platform. It’s authorized by the Saudi Central Bank, so completely safe to use.

Here’s the process:

First, go to tameeni.com and switch to English if needed.

Second, tap on the car insurance option from the main menu.

Third, select whether you want third party or comprehensive coverage.

Fourth, enter your identification number:

- Saudi citizens: National ID

- Expatriates: Iqama number

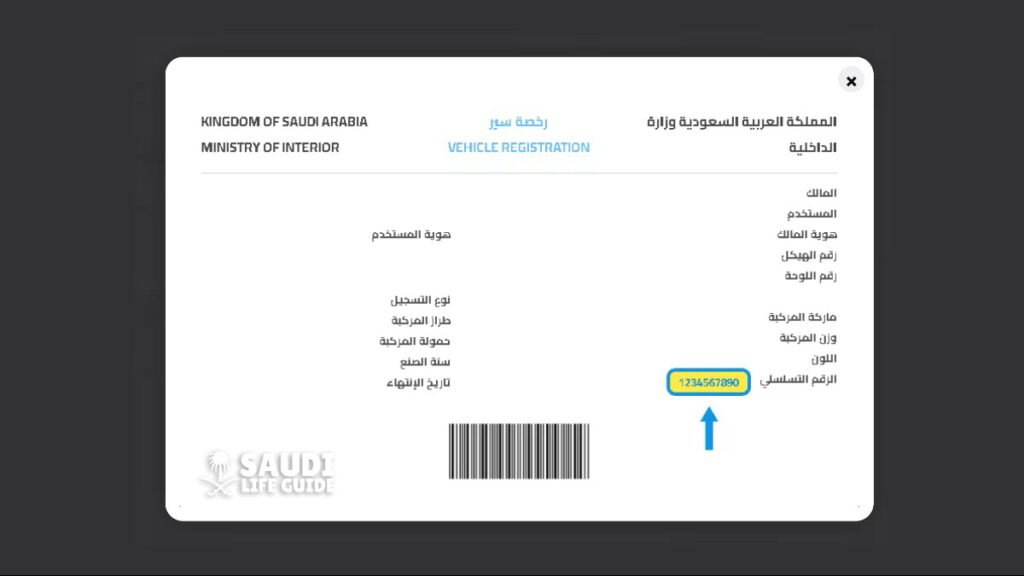

Fifth, type your vehicle sequence number. You’ll find this on your Istimara card – it’s the number identifying your specific vehicle.

Sixth, agree to the terms and hit the search button.

Seventh, browse through all available quotes. You’ll see prices from 20+ insurance companies side by side.

Eighth, pick the policy that fits your budget and needs.

Ninth, fill in additional vehicle information as requested.

Finally, pay using your credit card, mada card, or other available methods.

Your policy arrives instantly via email and SMS.

Other Trusted Comparison Websites

Tameeni isn’t your only option. Try these platforms too:

| Platform | Insurance Companies | Special Features |

|---|---|---|

| Tameeni | 25+ | Largest selection |

| Yaqeen | 20+ | Price match guarantee |

| Mulkiya | 18+ | Vehicle history included |

| Najm | 15+ | Accident services built-in |

Smart Move: Check 2-3 platforms before deciding. Some insurers offer exclusive deals on specific websites.

What You Need Before Starting

Gather these documents first to avoid delays:

✅ Valid Saudi driving license

✅ Iqama (expatriates) or National ID (citizens)

✅ Istimara – vehicle registration card

✅ Vehicle sequence number from Istimara

✅ Previous insurance details (for renewals)

✅ Fahas certificate – vehicle inspection report

7 Proven Ways to Lower Your Premium

1. Raise Your Deductible Amount

The deductible is what you pay before insurance kicks in. Choose a higher deductible and your monthly premium drops significantly.

Example:

- SAR 500 deductible = Higher premium

- SAR 1,500 deductible = 15-25% savings

Only do this if you can afford the higher out-of-pocket cost during claims.

2. Keep Your Driving Record Clean

Saudi Arabia tracks your driving history through the Najm system. Every accident and claim gets recorded.

Three years without claims? You could earn up to 30% discount on renewals.

3. Skip the Agency Repairs Option

Comprehensive policies offer two repair choices:

- Agency repairs (official dealership)

- Non-agency repairs (approved workshops)

Choosing non-agency saves 20-30% on your premium. The quality difference is often minimal.

4. Pay the Full Year Upfront

Monthly payments seem easier but cost more. Annual lump-sum payments typically save 5-8% compared to installments.

5. Add Security Features

Installing anti-theft devices or GPS trackers can reduce premiums by 5-10%. Some insurers require proof of installation.

6. Bundle Family Vehicles

Insuring multiple cars with the same company? Ask about multi-vehicle discounts. Many providers offer 10-15% off for family bundles.

7. Never Auto-Renew Blindly

Your circumstances change yearly. Maybe you drove less. Maybe your car depreciated. Always compare fresh quotes before renewal.

Top Insurance Providers Ranked

Based on customer satisfaction and claim settlement rates:

| Company | SAMA Rating | Claim Success Rate | Starting Price (TPL) |

|---|---|---|---|

| Tawuniya | A+ | 94% | SAR 850 |

| Al Rajhi Takaful | A | 91% | SAR 780 |

| Bupa Arabia | A+ | 92% | SAR 920 |

| Medgulf | A | 89% | SAR 800 |

| Walaa | A | 88% | SAR 750 |

| Gulf Union | A- | 87% | SAR 720 |

| Malath | B+ | 85% | SAR 690 |

What Affects Your Insurance Price?

Several factors determine your quote:

About You:

- Age (under 25 pays more)

- Years of driving experience

- Accident and claims history

- Traffic violations on Saher system

About Your Car:

- Make and model

- Manufacturing year

- Engine size

- Current market value

About Your Location:

- City of registration

- Urban vs rural areas

Average Costs by Vehicle Type

Here’s what drivers typically pay:

Economy Cars (Hyundai Accent, Toyota Yaris)

- Third Party: SAR 700 – 900

- Comprehensive: SAR 2,000 – 3,000

Family Sedans (Toyota Camry, Honda Accord)

- Third Party: SAR 900 – 1,200

- Comprehensive: SAR 3,000 – 4,500

SUVs (Land Cruiser, Nissan Patrol)

- Third Party: SAR 1,100 – 1,500

- Comprehensive: SAR 4,500 – 7,000

Luxury Vehicles (Mercedes, BMW, Lexus)

- Third Party: SAR 1,300 – 1,800

- Comprehensive: SAR 6,000 – 12,000

Special Tips for Expatriates

If you’re an expat in Saudi Arabia, keep these points in mind:

Documentation matters. Your Iqama must have at least 3 months validity remaining.

Local experience counts. Saudi driving history is valued more than foreign experience. Build your local record.

Get a Saudi license. Convert your international license as soon as eligible. It often results in better rates.

Language support exists. Choose insurers offering customer service in your language for easier claims processing.

How to File a Claim

Accidents happen. Here’s what to do:

Step 1: Report to Najm within 24 hours. They handle accident documentation.

Step 2: Get your official accident report from Najm or traffic police.

Step 3: Contact your insurance company via app, website, or phone.

Step 4: Submit photos, reports, and required documents.

Step 5: Take your car for assessment at an approved surveyor.

Step 6: Get repair authorization and fix your vehicle.

Step 7: Receive claim settlement (usually 7-14 working days).

Common Questions Answered

Is car insurance mandatory in Saudi Arabia?

Yes. At minimum, you need third party liability coverage. Driving uninsured can result in fines up to SAR 2,000 and vehicle impoundment.

Can I transfer insurance to a new car?

Most insurers allow transfers. Your premium adjusts based on the new vehicle’s value and specifications.

How fast can I get insured online?

Through comparison websites, the entire process takes 10-15 minutes. Your policy activates immediately after payment.

Does my Saudi insurance work in other GCC countries?

Standard policies typically cover GCC nations. Confirm specific terms with your provider before traveling.

What happens if I have multiple accidents?

Your premium increases at renewal. Some insurers may refuse coverage if your record shows too many claims.

Final Thoughts

Finding cheap car insurance in Saudi Arabia isn’t complicated once you know the system. Use comparison websites, maintain clean driving records, and review your options yearly.

Don’t just pick the cheapest quote blindly. Check the claim settlement ratio and customer reviews too. A slightly higher premium with reliable service beats a cheap policy that fails when you need it.

Start comparing today and keep more riyals in your pocket.