Minimum Salary in Saudi Arabia 2026 is often misunderstood, especially when comparing Saudis and expats. This guide explains the key salary thresholds (including the Nitaqat SAR 4,000 rule for Saudis) and what employers are actually required to pay. You’ll also learn how WPS/Mudad and other compliance rules impact salaries in Saudi Arabia.

Minimum Wage in Saudi Arabia Explained: Law vs Saudization Salary Requirements

Saudi Arabia often gets searched for a “minimum wage,” but in practice, there are two different concepts people mix up:

- A true statutory minimum wage (a single nationwide number everyone must be paid), and

- Regulatory salary thresholds that affect Saudization (Nitaqat), GOSI registration, and government services, especially for Saudi nationals in the private sector.

Quick Summary (2026)

| Topic | Saudis (Private Sector) | Expats (Private Sector) |

| Is there a single nationwide legal minimum wage? | Not as a universal “minimum wage” for all jobs; however Saudization counting uses a strict wage threshold | No statutory minimum wage under the general Labor Law |

| Most-cited “minimum salary” figure | SAR 4,000/month (critical for Nitaqat / Saudization counting) | Not defined; salary is whatever is in the contract (must be paid via WPS if covered) |

| Salary monitoring system | Wage Protection System (WPS / Mudad) where applicable | WPS / Mudad where applicable |

| Key authority | Ministry of Human Resources and Social Development (MHRSD / MoHRSD) | MHRSD / MoHRSD |

1) Is There an Official Minimum Wage in Saudi Arabia in 2026?

For Saudis

Saudi Arabia does not operate exactly like some countries that publish one nationwide minimum wage for every worker in every role. Instead, the most practically important “minimum” number for Saudi nationals in the private sector is the salary threshold used for Saudization (Nitaqat) counting.

In 2026, the widely enforced threshold remains: SAR 4,000/month for a Saudi employee to be counted as one full Saudi in Nitaqat (details below). This figure is repeatedly referenced by Saudi HR portals and expat guides because it directly impacts an employer’s ability to maintain a compliant Nitaqat category and access government services.

For Expats

For non-Saudi employees (expats) in the private sector, Saudi Labor Law does not set a universal minimum wage. The wage is determined by the employment contract, but the employer must pay it on time and in the agreed form (and, for covered employers, via WPS/Mudad).

Key takeaway:

- SAR 4,000 is not an expat minimum wage.

- It’s mainly a Saudization/Nitaqat counting threshold for Saudi nationals.

Primary references: MHRSD Saudization/Nitaqat policy updates; Saudi Labor Law (Royal Decree No. M/51 and amendments); WPS/Mudad compliance framework.

2) Minimum Salary for Saudis in the Private Sector (Nitaqat Thresholds) 2026

The Nitaqat “Count” Is the Real Enforcement Tool

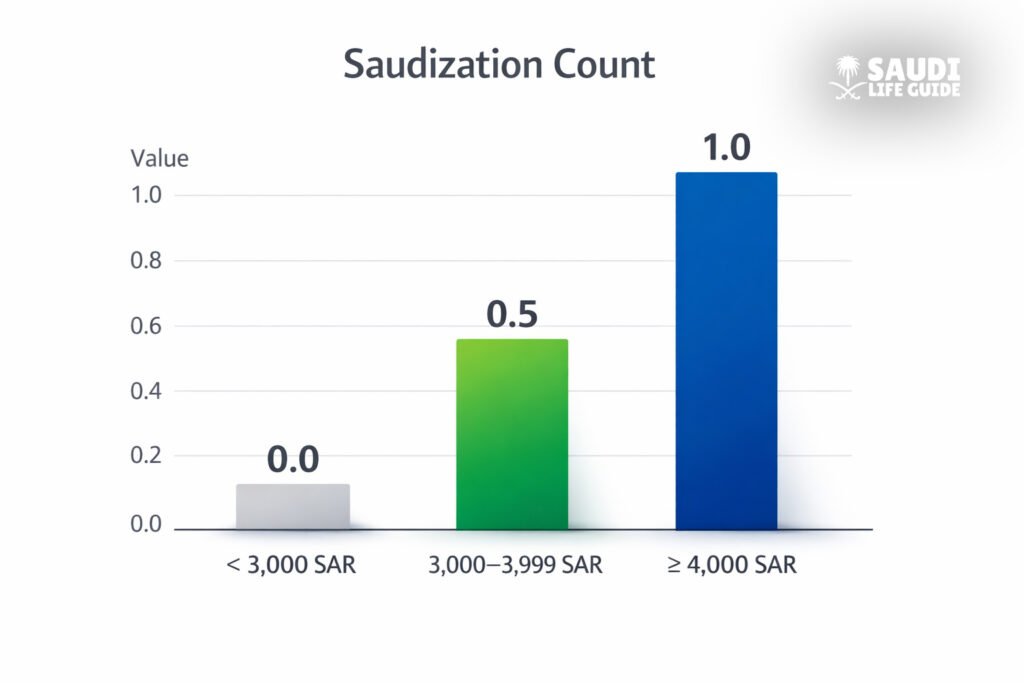

Under the Saudization/Nitaqat framework, not every registered Saudi employee counts equally. Salary level determines how much the employee counts toward the employer’s Saudization quota.

Nitaqat counting bands (commonly applied)

| Saudi employee monthly wage | Nitaqat / Saudization “count” impact (typical rule) |

| Below SAR 3,000 | Does not count toward Saudization |

| SAR 3,000 – 3,999 | Counts as 0.5 Saudi |

| SAR 4,000 and above | Counts as 1.0 Saudi |

This is why so many Saudi HR discussions call SAR 4,000 the “minimum salary for Saudis” even though technically it’s a compliance threshold, not a universal minimum wage for every workplace.

Simple Visual: Saudi Salary vs Saudization Count

Why the SAR 4,000 Threshold Matters (Beyond “Counting”)

For employers, falling short can trigger:

- Lower Nitaqat category (or inability to improve it)

- Restrictions on services (often linked to compliance level), depending on the company’s status and sector rules

- Increased HR/legal exposure if payroll practices appear abusive or non-compliant

For Saudi employees, it often affects:

- Market expectations for entry-level private sector pay

- How seriously an employer is perceived (since underpaying Saudis can weaken the company’s compliance position)

3) What About Expats? Minimum Salary for Expats in Saudi Arabia (2026)

3.1 No Statutory Minimum Wage for Expats

For expats in the private sector, the enforceable rule is:

- The salary must be clearly defined in the employment contract

- The employer must pay on time

- For covered companies, wages must be paid through WPS (Mudad)

So in 2026:

- There is no single legal “minimum salary for expats” number that applies across the board.

3.2 What Expats Often Confuse as a “Minimum.”

Even without a legal minimum wage, expats commonly encounter salary thresholds created by process requirements, bank policies, or common administrative practice. These are not the same as a legal minimum wage.

Common “thresholds” people refer to (not a labor-law minimum)

| Situation | “Typical” salary threshold people encounter | Notes |

| Family residence visa (bringing spouse/children) | Often cited as SAR 4,000 + accommodation or SAR 5,000 without | This can vary by profession, documentation, and current administrative practice; treat as practical guidance, not a guaranteed rule |

| Personal loan / credit card eligibility | Bank-specific (often SAR 3,000–5,000+) | This is a bank risk policy, not labor regulation |

| Renting / leasing (some landlords) | Informal thresholds | Not a government wage rule |

Important: If you’re writing HR policy or planning a move, always verify the latest requirement through official channels (e.g., Qiwa, relevant visa portals, or the issuing authority) because practice can shift.

4) Domestic Workers: Are There Minimum Salaries in 2026?

Domestic workers (housemaids, drivers, caregivers) operate under a distinct framework compared to standard private-sector employees. Their wages are frequently influenced by:

- Recruitment contracts

- Bilateral agreements between Saudi Arabia and sending countries

- Platform and process rules (commonly through Musaned for recruitment)

Because the wage can differ by nationality and agreement terms, it’s not accurate to publish one universal “domestic worker minimum wage” without checking the current Musaned contract and official agreement terms at the time of hiring.

Practical 2026 guidance:

- Treat domestic worker wages as contract-driven, shaped by recruitment channel and official agreements, and confirm the current baseline in the official recruitment workflow.

5) Entities You Must Know (Saudi Minimum Salary & Payroll Compliance Ecosystem)

These are the most relevant bodies and systems people repeatedly reference when discussing “minimum salary” in KSA:

- MHRSD / MoHRSD (Ministry of Human Resources and Social Development)

Sets labor policy, Saudization/Nitaqat rules, and enforcement mechanisms. - Nitaqat (Saudization Program)

Links company classification to the share/quality of Saudi employment salary thresholds matter here. - Qiwa

Main platform for many labor relationship services, employment contract management, and mobility processes. - WPS / Mudad (Wage Protection System)

Tracks wage payments; can trigger compliance actions if wages are delayed or inconsistent. - GOSI (General Organization for Social Insurance)

Social insurance registration and contributions (especially relevant for Saudi nationals). - Saudi Labor Law (Royal Decree No. M/51)

The core legal framework governing employment terms, wages, and disputes.

6) WPS (Mudad) in 2026: Why It Matters Even Without a Minimum Wage

Even when a country doesn’t set a universal minimum wage for expats, it can still enforce wage rules strongly through payment monitoring. That’s exactly what WPS/Mudad does in Saudi Arabia for covered employers.

What WPS typically enforces

- Salary is paid on time

- Salary matches the registered contract/payroll file

- Payments go through approved channels

- Reduces underpayment/late payment disputes by creating a traceable payroll record

What happens if an employer doesn’t comply?

Consequences can include:

- Blocking/suspension of certain services

- Escalation to labor compliance processes

- Increased difficulty processing workforce-related government services

7) GOSI and Salary: A Key “Real World” Salary Signal (Especially for Saudis)

For Saudi nationals, being registered correctly in GOSI and having a realistic contributory wage is a major compliance and benefits issue.

Why it matters

- Pension and insurance benefits are tied to reported wages

- Under-reporting wages can affect the employee’s long-term entitlements and can raise compliance flags

Commonly referenced contribution structure (illustrative, confirm current rates):

- Saudis: pension contributions split between employer and employee, plus unemployment insurance (SANED) structure

- Non-Saudis: typically occupational hazard coverage paid by employer

(Verify current contribution percentages directly with GOSI publications.)

8) 2026 Outlook: Will Saudi Arabia Raise the Minimum Salary?

As of the latest broadly-circulated policy framework leading into 2026:

- The most meaningful “minimum salary” number in the market remains the SAR 4,000 Saudization counting threshold for Saudi nationals in the private sector.

- No universal minimum wage for expats has been introduced under the general Labor Law.

What could change in the future (watch list)

- Sector-specific localization programs (some professions become Saudized with additional compliance requirements)

- Stricter WPS analytics (more automated compliance actions)

- Classification and skill frameworks that indirectly push wage floors upward in certain roles

Best practice for 2026: If you’re an employer, treat the SAR 4,000 Saudi threshold as a baseline planning number for roles intended to support Saudization compliance.

9) Practical Guidance (Employees & Employers)

If you are a Saudi job seeker (private sector)

- If an offer is below SAR 3,000, it may not count for the employer’s Saudization needs this can signal a higher-risk/low-commitment job structure.

- SAR 4,000+ is the key threshold that usually makes the role “fully count” for Nitaqat; many employers structure offers accordingly.

If you are an expat employee

- Focus on contract clarity (basic salary vs allowances), payment date, and whether salary is paid through WPS.

- If someone claims “the minimum wage is X,” ask:

“Is that a legal minimum wage, a visa requirement, a bank rule, or a Saudization threshold?”

If you are an employer / HR

- For Saudi hires, structure compensation with the Nitaqat counting thresholds in mind.

- Keep Qiwa contracts, GOSI registration, and WPS payroll files consistent to reduce disputes and compliance interruptions.

FAQs

What is the minimum salary for Saudis in Saudi Arabia in 2026?

In practice, the most important figure is SAR 4,000/month in the private sector because it is the common threshold for a Saudi employee to count as 1 full employee under Nitaqat/Saudization. Salaries SAR 3,000–3,999 may count as half, and below SAR 3,000 may not count.

What is the minimum salary for expats in Saudi Arabia in 2026?

There is no universal statutory minimum wage for expats under the general Saudi Labor Law. The legal requirement is that the wage must be specified in the contract and paid according to the rules (often monitored through WPS/Mudad for covered employers).

Is SAR 4,000 the minimum wage for everyone?

No. SAR 4,000 is primarily a Saudization/Nitaqat counting threshold for Saudi nationals in the private sector commonly mistaken as a universal minimum wage.

Does WPS mean the government sets the salary amount?

No. WPS mainly ensures the salary agreed in the contract is actually paid on time and in a traceable way.